Well, we made some progress.

Well, we made some progress.

That’s right, we opened on Monday at 2,763 and closed at 2,750 on the S&P (/ES) and this morning we’re at 2,782 and climbing on a supportive note out of China, whose entral bank governor and banking and securities regulators said recent volatility in Chinese stocks didn’t reflect the nation’s economic fundamentals and “stable financial system.”

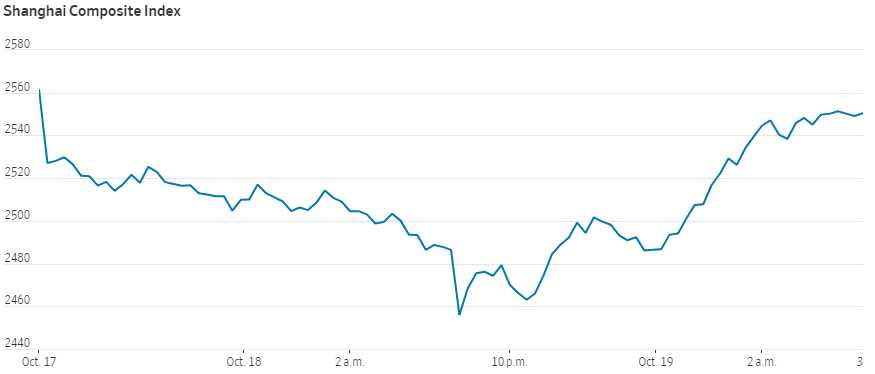

That flipped the Shanghai up 2.5% into the close, reversing a sharp downturn as China released weaker (6.5%) GDP data than expected (6.7%). Chinese exports, by the way, held steady from last quarter as they are not, so far, being affected much by Trump’s tarrifs, which is actually bad because that means that there’s more potential trouble for their economy ahead. In fact, exports got a boost in Q3 as shippers raced to push goods out under the tariffs, Q4 may paint a very different picture and these are only 10% tariffs – Trump wants to go to 25% and he will if he comes back in November with continued control of Congress – a good reason for China to meddle in our election!

Yesterday morning I warned you not to be fooled by a “dead cat bounce” and we promptly fell off a cliff and lost a lot of our gains. Fortunately, at 3:01 pm in Wednesday’s Live Member Chat Room, I repeated our Webinar call to short the S&P (/ES) Futures at 2,815, which led to a very nice $2,500 per contract gain at 2,765 yesterday afternoon. This is why we say “Wheeeee!” when the market sells off – it’s fun when you know how to hedge!

Yesterday morning I warned you not to be fooled by a “dead cat bounce” and we promptly fell off a cliff and lost a lot of our gains. Fortunately, at 3:01 pm in Wednesday’s Live Member Chat Room, I repeated our Webinar call to short the S&P (/ES) Futures at 2,815, which led to a very nice $2,500 per contract gain at 2,765 yesterday afternoon. This is why we say “Wheeeee!” when the market sells off – it’s fun when you know how to hedge!

You can follow our logic and learn our trading signals by watching a replay of Wednesday’s Live Trading Webinar here.

Speaking of singals, I also called the bottom and flipped our Nasdaq Ultra-Short (SQQQ) hedges bullish by cashing in our long calls (leaving us with naked short calls) at 2:10 pm, saying:

SQQQ – I think today’s sell-off was a gift horse so let’s cash these out and wait