Many of you know that I have been covering Landmark Infrastructure (LMRK) for over a year and in my first research report I explained,

I decided that I would take a new path and write about a Master Limited Partnership (or MLP). Don’t worry, I’m not going to invade on the more volatile MPL sector – I don’t particularly care for “partnerships” that report to investors that receive K1 forms rather than the 1099s – and I am not particularly keen on external management.

Of course, it has been was well over a year since that first report, and since that time the company has taken major steps to simplify certain tax requirements that affect unit holders and by expanding its business strategy.

More specifically, Landmark made changes last year broaden the investor base by substantially eliminating unrelated business taxable income, otherwise known as UBTI. Landmark also significantly simplified its state income tax filings for unit holders. With this change, the company did not eliminate the Partnership structure since that will continue to give the company operating flexibility.

So essentially, when you own shares in this MLP you are also investing in the REIT subsidiary, so it makes perfect sense to include Landmark in our REIT coverage where the company is considered an infrastructure investor.

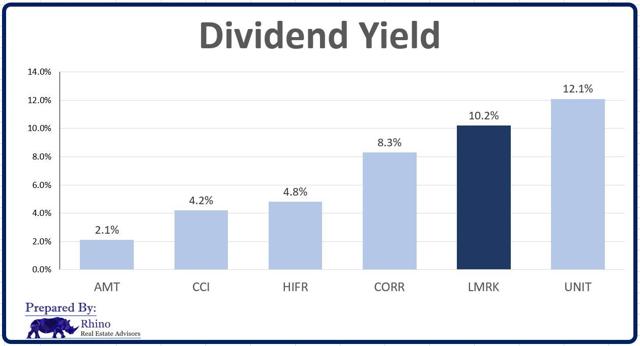

In fact, we plan to beef up coverage in the Intelligent REIT Lab, we already have Zayo Group (ZAYO) pegged to enter REIT-dom and we now cover a number of REITs including Hannon Armstrong (HASI), American Tower (AMT), Crown Castle (CCI), and CorEnergy (CORR). We believe it makes perfect sense for these companies to operate under the REIT structure and we expect to see new players in the future.

But for now, Landmark is still an MLP with a REIT subsidiary, and you know what I mean with the title now: “Look! It’s a Bird, It’s a plane, It’s Landmark Infrastructure”.

Maintaining a ‘Spec Buy” and Here’s Why

I have maintained (since my first article) that Landmark is a “speculative Buy” that offers investors a very high yield (10.2% as I write this article) for the opportunity to own net-leased infrastructure assets.

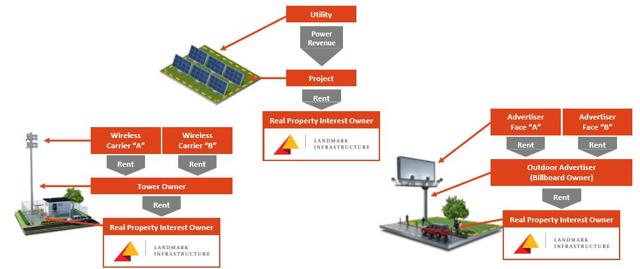

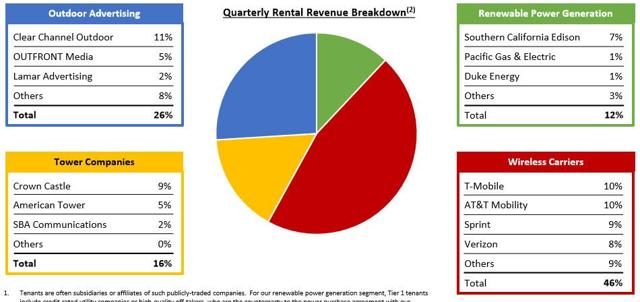

At a high level, Landmark provides investors with an attractive opportunity to own real property interests that underlie tenants with operationally essential infrastructure assets. The company serves three masters: wireless communication, outdoor advertising, and renewable power generation industries.

The company sees many opportunities internationally as well as with operating partners that have a unique expertise and experience in industry relationships that complement the company’s efforts at the Partnership and the sponsor. Landmark’s asset portfolio represents less than 1% of the total U.S. market that suggests strong growth in a highly fragmented sector.

New wireless sites alone added each year are expected to be greater than the entire existing portfolio. Most individual property owners in this industry have only one or two locations.

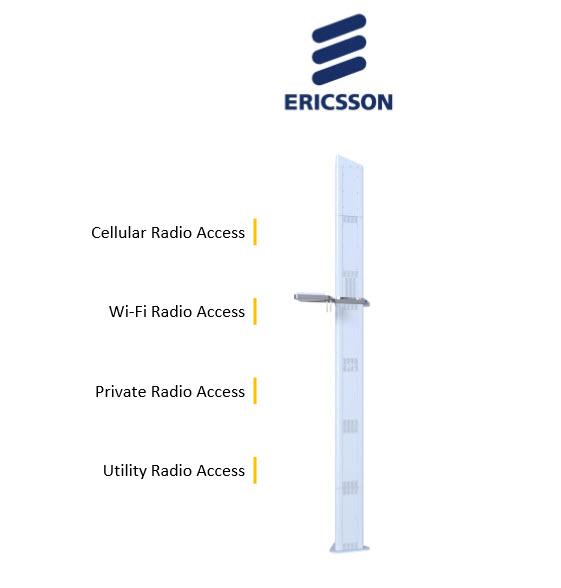

Within the wireless sector (70% of revenue), LMRK’s Partnership sponsor and Ericsson (NASDAQ:ERIC) recently announced the selection of Ericsson to deploy the Zero Site microgrid solution across North America.

The self-contained, neutral-host smart pole is designed for carrier and other wireless operator colocation, and the Zero Site is designed for macro, mini macro, and small cell deployments and will support IoT, carrier densification needs, private LTE networks, and other wireless solutions.

As wireless carriers increase their capital spending for 5G deployment, Landmark stands to benefit in a number of ways. First, it expects to see higher leasing activity at existing and new sites as the carriers expand and need additional locations. Second, lease modifications are expected to increase as more space is required and additional equipment is added to sites.

Landmark also stands to benefit in the outdoor advertising sector (20% of LMRK’s revenue). Outdoor advertising remains one of the most cost-effective means of advertising and its market share has increased, even with the significant growth of internet and mobile advertising.

With the continuing shift in the industry from static to digital billboards, Landmark expects to benefit as certain ground leases in its portfolio participate in the growth of advertising revenue on those billboards.

Note: We recently upgraded Outfront Media (OUT) to a STRONG BUY last week and shares reacted accordingly:

Source: Yahoo! Finance

Landmark also expects further growth in renewable energy. Solar and wind electric generation capacity is expected to more than double over the next 30 years, and the company expects this will give it a significant opportunity to acquire renewable power generation real estate interests. The company plays primarily in the utility solar category, where it buys the land underneath massive solar projects.

Collectively, Landmark’s properties are difficult to replicate, with significant zoning, permitting, and regulatory hurdles in finding suitable new locations, including the time and cost of construction at a new site. Vacating tenants must often return the property to its original condition.

As viewed below, LMRK’s platform is highly desired by many Tier 1 tenants (many are large, publicly traded companies). No single tenant accounts for more than 11% of revenue:

Landmark’s Cost of Capital

Landmark targets leverage of 40% debt to enterprise value, which is in the 6-8x EBITDA range. The company is comfortable operating at slightly higher leverage relative to the peer group as revenues have much lower variability. Remember that operating expenses are low, and Landmark operates with mostly fixed rate debt.

There are multiple sources of attractive debt financing at this leverage level and Landmark uses a combination of revolver financing and secured notes to finance acquisitions. The company focuses on issuing fixed rate notes or hedging the variable interest rate exposure on the revolver. Landmark targets a diversified debt structure and minimizes the amount of maturities in any one year.

Over the last three quarters, Landmark has significantly changed the composition of its debt structure, with the completion of the outdoor advertising financing in November, renewables financing in April, and wireless communications financing in June.

Debt maturities have been pushed out, and approximately 100% of debt is fixed rate or hedged through interest rate swaps. The wireless communication financing in June of approximately $125 million was completed at an attractive weighted average coupon rate of 4.31%.

Around 30days ago Landmark announced it had entered into an agreement pursuant to which an affiliate of Brookfield Asset Management (BAM) had made a strategic investment with Landmark to form a JV to invest in core infrastructure assets. In the transaction, Landmark contributed a portfolio of assets, including the associated debt, in exchange for an approximate 50% interest in the JV and $65.5 million in cash.

Landmark plans to use the proceeds from this transaction to reduce its leverage levels and reinvest in assets in its primary industries through its various acquisition and development activities. This deal expands the access to capital for Landmark and gives the company enhanced scale to partner with a company like Brookfield. More importantly, the capital provides Landmark with around $65 million in dry powder to redeploy into more accretive growth opportunities.

Landmark is seeing assets priced at attractive cap rates and has been selective in what it has acquired. Acquisition cap rates have generally been in the 6% to 7% range over the last three years depending on the asset class. One of the drivers for Landmark has been in its FlexGrid product.

Landmark plans to invest around $50 million into this asset class that generates enhanced returns, around 300 bp profit margins. The core business is expected to grow by around $200 to $250 million and Landmark generates spreads of around 100 bps, based on my estimated WACC of 6.25% to 6.5%.

Landmark’s FlexGrid model is focused on three initial segments: municipalities, transportation authorities and commercial real estate owners. As Landmark’s CEO explains on the recent earnings call,

Our FlexGrid solution has been very well received and the pipeline of potential opportunities continues to expand. With the massive network densification needs of the mobile network operators, our FlexGrid solution is an ideal method for deploying wireless equipment in strategic locations without cluttering existing infrastructure.

It can be challenging for parties to find appropriate solutions that meet the needs and objectives of all those involved. MNOs are finding it more and more challenging to deploy equipment in rights of way and as attachments to existing infrastructure.

Similarly, municipalities are focused on controlling the deployment of telecom infrastructure in ways that meet the needs of the communities they serve. The FlexGrid is an ideal solution because it’s a neutral host collocation environment that meets the specific needs of both the real estate owners and the MNOs and can support deployments ranging from small sales to macro level installations. The FlexGrid solution is highly customizable and can be deployed quickly to meet the needs of all of the project stakeholders.

The Latest Earnings Results

For Q2-18, Landmark posted another solid quarter of operating and financial results. Rental revenue grew 31% year over year led by acquisitions completed in the last 12 months and the strong and consistent growth profile of the portfolio.

Landmark’s assets continue to perform driven by their high-quality cash flows and the steady and sustainable growth from contractual lease escalators, while churn on the portfolio remains extremely low.

Year to date through July 31st, Landmark acquired 186 assets for total consideration of approximately $128 million. Those assets are expected to contribute $9.4 million in annual rents and were comprised of 61 wireless communication, 118 outdoor advertising and seven renewable power generation assets. Through July 31st, Landmark has invested approximately $38 million in the U.K. since inception and anticipates substantial acquisition growth in the second half of this year.

In Q2-17 Landmark’s Adjusted EBITDA, which excludes several non-cash items, including unrealized gain on derivatives and acquisition-related expenses, increased to $16.5 million, an increase of 30% year over year. Landmark ended the quarter with 2,327 leased tenant sites out of a total of 2,415 available tenant sites, with an occupancy rate for the quarter of 96%.

Landmark’s quarterly distribution remains flat “until revenue reported from investments catches up with the distribution declared.” The coverage ratio, which is defined as distributable cash flow divided by distributions declared on the weighted average common units outstanding during the quarter, is 0.86x.

The coverage ratio declined slightly due to the issuance of the Series C preferred units. With the Series C preferred offering Landmark has essentially raised all of the capital needed to meet its 2018 acquisition guidance.

The main reason for the higher payout ratio is the timing of capital raises and the subsequent deployment of that capital. As Landmark continues to grow, the impact of future capital raises to the payout ratio should diminish.

Sucker Yield?

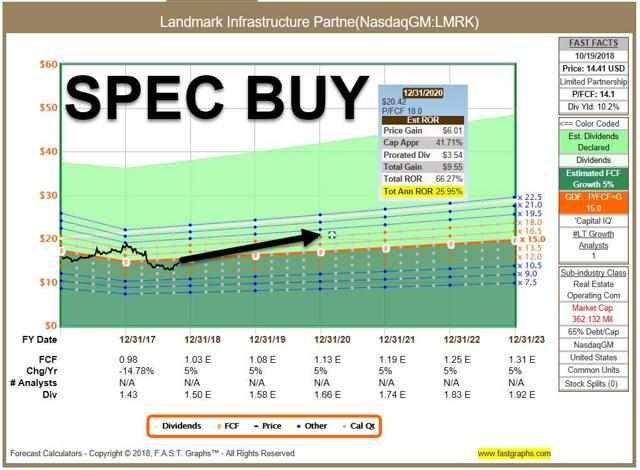

As mentioned above, we are maintaining a SPEC BUY on Landmark shares and while we recognize the yield is outsize due to the payout ratio, we believe the company is working to reduce the stress (to the dividend).

As mentioned above, Landmark recently entered into a JV deal with BAM to unlock value and this means that the company could transact similar deals in the future. In addition, we believe there’s untapped value in Landmark’s billboard assets that could be easily monetized with Outfront or Lamar (LAMR).

As noted, part of the dilemma with Landmark is the unique hybrid status – some REIT attributes and some MLP attributes – but since the company is an MLP it reports distributable cash flow. Remembering that EPS is an MLP term and MLPs were designed to distribute all free cash flow.

Also, keep in mind that Landmark is nothing more than a net lease vehicle, so all expenses are passed along to the tenant. As a result, the payout ratio is not all that concerning.

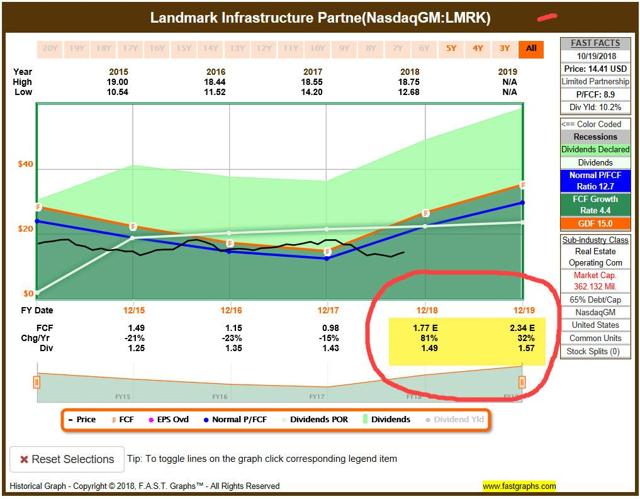

As the above FAST Graph illustrates, Landmark is forecasted to grow free cash flow considerably in 2019 and 2020 and if these analyst estimates are somewhat accurate the dividend will be more than well-covered. I know these are just analyst opinions, but the rationale is promising.

But as I said, the billboard assets could easily fetch 18-19x (low 5% cap rate) and I can see Landmark deploying proceeds into more accretive deals like the FlexGrid product.

In the upcoming edition of the Forbes Real Estate Investor I plan to take a deep dive into the data and fiber business. I have been working on research and I am convinced that the demand for data is going to explode over the next decade. Infrastructure REITs will be an important part of the ecosystem and Landmark has carved out a unique footprint that is misunderstood by many analysts and investors.

I can’t recommend “backing up the truck” for a small-cap ($350M market cap) MLP/REIT, but I can suggest a SPEC BUY for this little gem that is likely to generate some impressive returns over the next 12-24 months. I plan to meet with management in a few weeks at NAREIT’s REIT World and if you are a marketplace subscriber please let me know of any specific questions you have (for me or Landmark management).

Author’s note: Brad Thomas is a Wall Street writer and that means he is not always right with his predictions or recommendations. That also applies to his grammar. Please excuse any typos and be assured that he will do his best to correct any errors, if they are overlooked.

Finally, this article is free, and the sole purpose for writing it is to assist with research, while also providing a forum for second-level thinking.

Source: F.A.S.T. Graphs and SKT Investor Presentation.

Brad Thomas is one of the most read authors on Seeking Alpha, and over the years, he has developed a trusted brand in the REIT sector. His articles generate significant traffic (around 500,000 views monthly) and he has thousands of satisfied customers who rely on his expertise.

Marketplace subscribers have access to a growing list of services, including weekly property sector updates and weekly recommendations. Also, we are now providing daily early morning REIT recaps, including breaking news across the entire REIT universe.

For new subscribers we will include a free signed copy of The Intelligent REIT Investor. Act now!

Disclosure: I am/we are long ACC, APLE, AVB, BHR, BPY, BRX, BXMT, CCI, CIO, CLDT, CONE, CORR, CTRE, CXP, CUBE, DEA, DLR, DOC, EPR, EQIX, ESS, EXR, FRT, GDS, GEO, GMRE, GPMT, HASI, HT, HTA, INN, IRET, IRM, JCAP, KIM, KREF, KRG, LADR, LAND, LMRK, LTC, MNR, MPW, NNN, NXRT, O, OFC, OHI, OUT, PEB, PEI, PK, PSB, PTTTS, QTS, REG, RHP, RLJ, ROIC, SBRA, SKT, SPG, SRC, STAG, STOR, TCO, TRTX, UBA, UMH, UNIT, VER, VICI, VNO, VNQ, VTR, WPC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.