Genworth MI Canada Inc. (OTCPK:GMICF) (MIC on TSX) was spun off of Genworth Financial Inc. (GNW) in 2009. Providing mortgage insurance to Canadians, Genworth MI is the second largest Canadian provider of mortgage insurance products after the Canadian Mortgage and Housing Corp. (CMHC), a federally controlled Crown corporation. Genworth MI is the largest private insurer of mortgages in Canada. The company has a majority shareholder, being GNW with approximately 57% ownership.

Genworth MI Canada has been a major holding in my RRSP portfolio for approximately 5 years. (RRSP is the Canadian version of an IRA). Since my original position, the share value of the company has increased in value close to 23%. I am considering adding to my position as the company appears close to the right price to trigger a purchase.

My investment strategy is focused around the long-term hold of companies which have a history of dividend increases every year. Following a Dividend Growth Investment strategy (DGI), I accept the fact that only healthy, well run companies can increase their dividends annually over an extended number of years. In the event of a failure to raise the dividend over 6 quarters, or a reduction in dividend or missed dividend payment, my intention is to sell that company, barring any other compelling reason to hold. So how has Genworth MI Canada held up over the last 5 years?

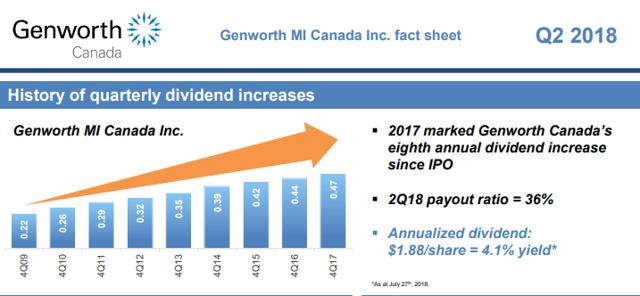

Genworth MI Canada has raised their dividends consistently since their inception in 2009 as shown in the chart below.

Source: Genworth MI Canada Fact Sheet

In the last 5 years, Genworth MI Canada has on average raised its dividend 5% annually. I anticipate a dividend increase announcement to occur in early November, bringing the dividend up to C$0.49. Based on the recent share price of C$40.32, this calculates to a yield of 4.86%.

The company has good stewardship under the leadership of Stuart Levings. He has been with the company since 2000, which included 5 years as CFO. Levings was appointed CEO in 2015.

The book value of the company is recorded on their most recent balance sheet at C$44.40. So why is a company with such an exemplary history, with good stewardship currently trading at a discount of 9% to book value? I can only surmise it is due to the hangover from the housing bubble along with the concerns in Canada of rising interest rates and the high level of consumer debt held by Canadians. Also, the GNW acquisition may be a factor as will be discussed below.

Regarding the company’s valuation, CEO Stuart Levings made some interesting comments at the CIBC 17th Annual Eastern Institutional Investor Conference on September 27, 2018. Levings noted that the company’s book value, in his opinion, was not the intrinsic value of the company. He explained his view was based on the company having C$2 billion in unearned premium just waiting to be earned into book value. He is of the view, this metric adds C$2.00 per share to recorded book value. He went on to qualify that this increase in intrinsic value would stand up to a stress loss situation.

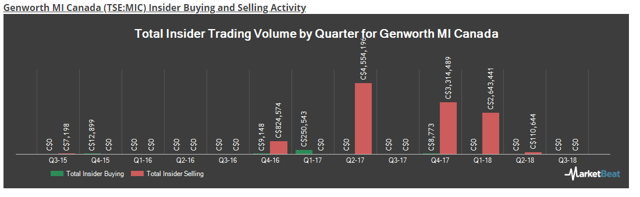

Given his comments, it would seem the CEO has an intrinsic value of the company around C$46.40 per share. Therefore, given the closing price of the company’s shares October 19, 2018 at C$40.32, it would indicate his view that the current share value reflects a 13% discount to intrinsic value. This by itself would be a reason to buy at today’s share price. Balancing this out is the reports that insiders are selling, not buying as reported by MarketBeat in the following chart.

Source: MarketBeat

With the company not focused on, or anticipating needs for capital as they have practically no chance within their industry in Canada to acquire other competitors, and given the company’s profitability, the question then becomes the best path for capital efficiency. The two obvious paths are share buybacks or special dividends to shareholders.

Twice in the company’s past they have issued special dividends. On November 15, 2011, a special dividend of C$0.50 was issued and then again on November 5, 2014 of C$0.43 per share. Since 2014 no special dividends have been issued. It appears the CEO and the Board of Directors are of the view the best use of capital is reducing the number of shares available on the market. At the CIBC September 27th conference, when asked if Genworth MI Canada would buy back shares in 2019, Levings responded “Absolutely”.

On review as to how the company has historically performed on Normal Course Issuer Bids (NCIB), Genworth MI Canada reports that the company had, last year, received approval from the TSX to purchase up to 4,658,577 common shares between May 5, 2017 and May 4, 2018. The company reports they purchased 2,342,673 common shares on the open market at an average purchase price of C$38.42 per share. The current 52-week low of C$38 and high of C$46.15 clearly shows the company and their agents are cost effective on their exercising of the NCIB.

One of the market’s historical issues with the future of this company was the concern about the Canadian housing market. There was previously a fear the market was overheated and the housing bubble could burst anytime. This concern has been abated in the past 2 years with tightening up of mortgage stress tests and increasing interest rates. With much of 2018 now in the rear-view mirror, the stress test on all new mortgages clearly continues to impact home sales.

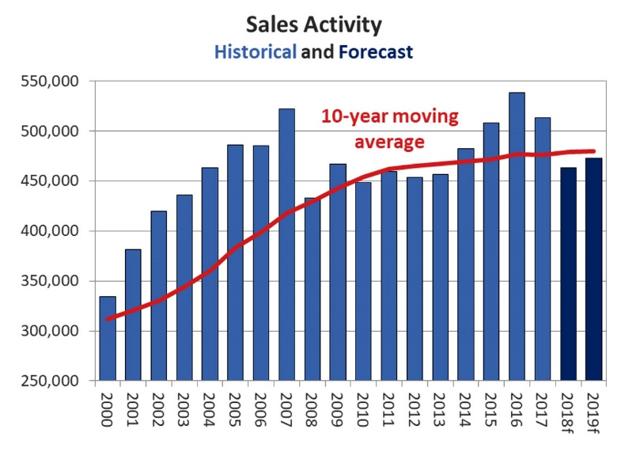

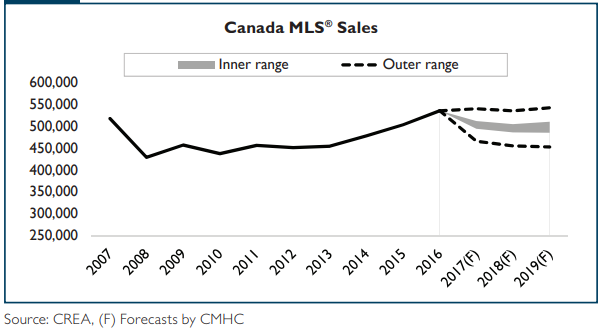

The Canadian Real Estate Association (CREA) released their updated forecast of the housing market on September 17, 2018. Their research determined that:

“National activity is on track to hit a five-year low in 2018. While summer sales activity in and around the Greater Toronto Area showed signs of rebounding, this trend may be losing steam. Moreover, additional interest rate increases expected this year and in 2019 will continue to raise the bar that borrowers must clear to qualify for mortgage financing.

Taking these factors into account, national sales are expected to decline by 9.8% to 462,900 units in 2018.”

Source: CREA

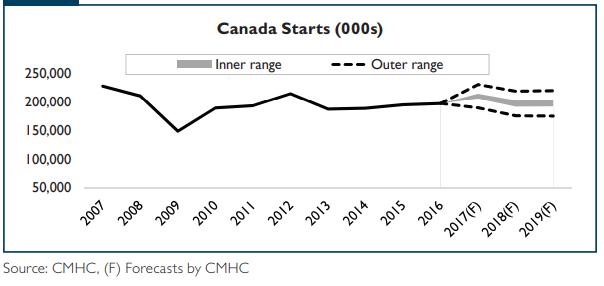

Dwelling starts in Canada have been tracking as follows:

Nationally in Canada, CMHC has reported on residential sales activity as shown in the chart below forecasting through 2019.

The biggest threats to Canadians who own homes with insured mortgages is the potential for increased mortgage rates, or declines in their income. It has been argued that increased mortgage rates will reduce property values and put younger homeowners underwater.

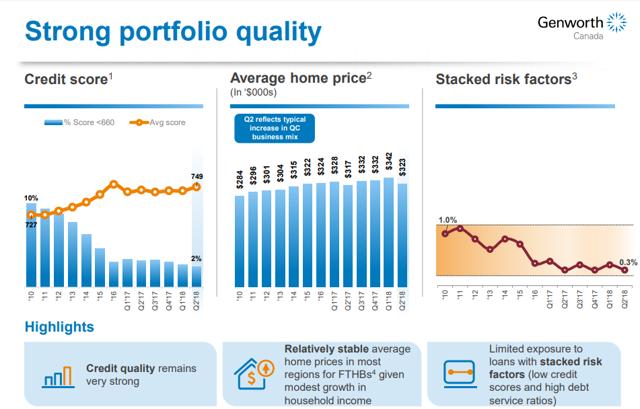

How will this possible scenario impact Genworth MI Canada? The CEO commented that their mortgage book of business has a very good loan to value, given real estate’s appreciation in price, coupled with lesser risks due to the age of certain portfolios in the book of business. He commented that the actual loan to value in many of the books of business were under 70%. This he said was a good buffer to the future in the event of any economic shocks.

In the company’s presentation for Q2, they note the following:

Source: Genworth MI Canada Earnings Presentation

Clearly, Genworth MI Canada is prepared for the future with a strong financial position. CEO Levings is of the view that Canada is in a very good environment of economic growth given that statistics show employment is up in Canada, and housing appears to be having a soft landing respecting the housing bubble of the last few years, especially in the greater Toronto area.

Looking ahead, the company sees potential shocks to the national economy from US tariffs. This comment in September by Levings was made prior to the USMCA agreement, so more likely than not, it is less of a worry today. The long financial cycle is a concern and markets may trend downward any time soon. This would impact investments, offset by rising interest rates. As well, economic downturns could drive up unemployment and mute growth in the mortgage marketplace.

One last issue is the pending sale of Genworth Financial, the majority shareholder, to China Oceanwide. Talks surrounding the purchase have been going on for quite some time. On August 14, 2018, GNW and China Oceanwide announced an agreement to extend the deadline of August 15, 2018 to December 1, 2018 to allow additional time to complete the regulatory review process. The Committee on Foreign Investment in the United State (CFIUS) has completed their review of the proposed transaction and concluded there are no unresolved national security concerns. There remains a few state regulatory approvals and some other international approvals, including those from China. It seems the most challenging hurdles have been crossed for the acquisition.

This seems to alleviate the fear that the acquisition deal would fall through. Had that happened, GNW may have had to sell its 57% stake in Genworth MI Canada to fulfill financial obligations GNW faces.

Now that it appears the purchase of GNW may occur by year-end, the question is whether China Oceanwide, upon acquisition, would be inclined to sell their Genworth MI Canada position to recover some of their incurred costs to secure GNW. If they did, what impact would the sale of 57% of the outstanding shares have on the value of Genworth MI Canada. From what I can ascertain, China Oceanwide would not be in a forced position to sell assets to complete the deal. But do they really want Genworth MI Canada? Or are they only interested in GNW assets found in the United States.

Arguments can be made that China Oceanwide might keep the company, acknowledging the cash from dividends is significant enough to offset any gains they could make by liquidating their position. I am of the view that on a balance of probabilities, it is more likely than not, that if the GNW shares of Genworth MI Canada were sold off, it would be done in an orderly and common sense manner over time to not impact the price in any volatile way. I would really appreciate others commenting on this issue.

Given the above, I am considering increasing my holding of Genworth MI Canada if the stock drops to its 52-week low of C$38.00/share.

Disclosure: I am/we are long GMICF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.