Don’t be fooled by weak bounces.

Don’t be fooled by weak bounces.

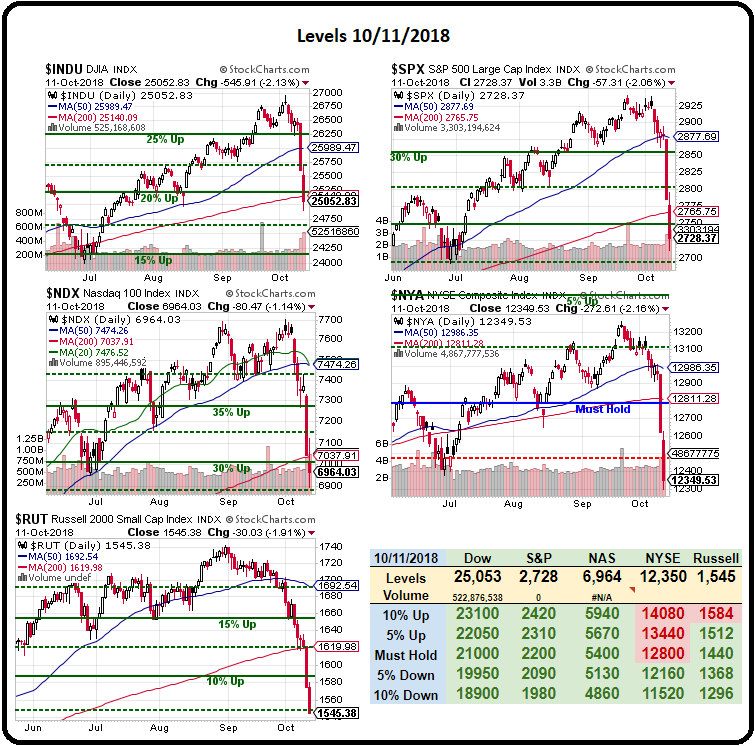

The Dow may be up 370 points at the open and that seems like a lot but we closed near 25,000 and, as noted in yesterday’s PSW Report, we were expecting a bounce off 25,175 back to 25,450 just to complete a WEAK bounce off the 5% correction (which we also predicted) and yesterday’s failure at the bounce line does not make a second attempt today more impressive. As we discussed in Wednesday’s Live Trading Webinar, it’s not just making the bounce lines that matter but making them in the same time period that we fell.

It took rwo days to hit 25,175 and yes, we did bounce back in one day yesterday but that failed and got worse and now it’s day 2 and all we’re doing this morning is making another run at 25,450 and that is not going to be enough to flip us bullish – now we need to see the strong bounce level at 25,700 taken and held – along with the levels we set for our other indexes as well. We called this in yesterday’s report, of course and I’ll repeat it again because we’re looking for the same factors in play:

Nothing has happened to support the markets so far but here are some of the things that can turn things around – at least to create a dip-buying rally but whether or not that’s enough to crack the strong bounce lines remains to be seen:

- Trump could stop calling the Fed “crazy” (not likely, he needs someone to blame for the market sell-off since he’s been using the market rally to measure his success)

- The Fed could capitulate to Trump and say they won’t raise rates anymore (not likely as yesterday’s 10-year auction was not pretty – even at 3.25%.