U.S. stock futures pointed to a deeply negative open Tuesday morning as investors continued to sell major technology and financial shares during this turbulent October for markets.

Netflix dropped 2 percent in premarket trading, set to add to its 11 percent drop this month. Amazon, Nvidia, Alphabet and Twitter shares were also set to open lower as investors worried about valuations for high-flying technology names with interest rates on the rise.

Bank of America declined 2 percent in premarket trading, set to add to its 7 percent loss for October as investors fretted that rising mortgage rates would crimp loan growth. Higher short-term rates may increase competition for bank deposits as well. Banks led the market lower on Monday.

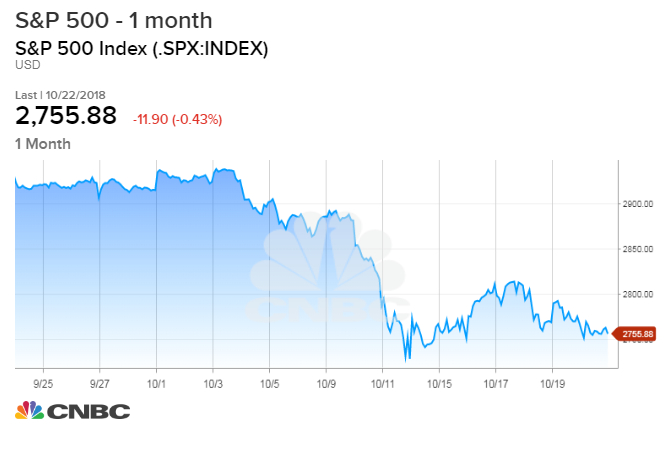

Dow futures around 6:40 a.m. ET indicated a negative open of more than 300 points. Futures on the S&P 500 and the Nasdaq also fell sharply. After its fourth straight daily decline on Monday, the S&P 500 sits less than 2 percent away from the low hit earlier this month during this ongoing sell-off.

Tuesday is a big day for corporate earnings, with McDonald’s, 3M, Caterpillar and a number of other firms set to report before the bell, and Juniper Networks, Equity Residential, Capital One and others due to post their financials after the trading session.

Global markets were also on edge amid geopolitical tensions surrounding Saudi Arabia.

Investor focus is largely attuned to developments in Saudi Arabia, after the country confirmed Jamal Khashoggi, a journalist and critic of the Saudi regime, was killed in the country’s consulate in Istanbul, Turkey.

European and Asian shares retreated on Tuesday as sentiment soured amid the escalating geopolitical worries. Europe’s Stoxx 600 fell to its lowest level since December 2016 in early morning trade, with concerns over Italy’s fiscal plans and Brexit also depressing sentiment, while Asian markets saw broad losses.

Meanwhile, Minneapolis Federal Reserve President Neel Kashkari, Atlanta Fed President Raphael Bostic, Chicago Fed President Charles Evans and Kansas City Fed President Esther George will speak throughout the day. In terms of data, the Richmond Fed is expected to release manufacturing index data at 10 a.m. ET.