I started writing about Brandywine Realty Trust (BDN) in January of 2017, a few months before I decided to initiate a position. In that article I said,

Brandywine is on my watchlist, and I expect to look for an entry point towards the end of the first quarter/early second quarter for a small position. My expectation is that this will be a long-term bet on the 2020s, with modest growth in the interim.

Most of the time, investments do not proceed in a straight line. With so many moving parts and a fickle Mr. Market, more often than not a well thought out investment will go up, down and sideways in unanticipated ways.

BDN data by YCharts

This has been the case with my position in BDN, which after an initial run-up has come down and is currently below my cost basis. Dividends received helps offset some of that loss, but the position is still in the red.

This loss can be attributed to a few things. First, the large drops correlate with broader drops among REITs in general. It is rather clear that these drops are associated with rising interest rates. I have discussed numerous times the reasons I believe that rising interest rates are a market created fear, rather than a fundamental problem for REITs. BDN, in particular, has a strong balance sheet and low exposure to variable interest rates, which should make rising rates a non-issue for their operations.

BDN data by YCharts

Second, comparing BDN to other office REITs, we can see that office REITs, in general, remain out of favor. A few of the drawbacks that investing in office space generally has is a relatively high cost of customizing office space to a particular tenant, technological changes dramatically changing how companies use office space and the long-term leases typically have low escalators, are flat or sometimes even have step-down rents which limit same-property growth.

I believe it is these challenges that have the market undervaluing office REITs as a class. While REITs in the industrial or data center sectors seem to have infinite growth pushing frothy valuations, the office sector has been left behind.

Cap-Ex

One of the most significant things that sets the office sector apart from others is the customized nature of the space.

An industrial warehouse is essentially a large empty space and there is not a significant difference between what one tenant wants and another might want. Modifications to the space are relatively easy and inexpensive.

An office, on the other hand, is highly customizable. How many small offices vs. large offices? Do you want space for cubicles? How many conference rooms? Do you want a reception area? How many break rooms? The space can be separated an infinite number of ways and any given tenant is going to have specific priorities. With office REITs, we are not talking about strip-mall style offices that will be leased by a small business that will just work with whatever they can afford, we are talking about regional or home offices that companies will want to be customized for high efficiency and a strong first impression for any visitors.

The cost of customizing that space is often a carrot used in negotiations to encourage tenants to sign a lease. Office REITs will often pay a sizable portion of the tenant improvements, which are then capitalized over the life of the lease.

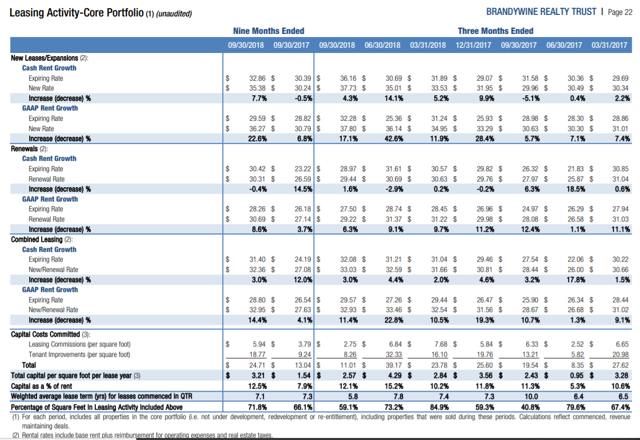

BDN reports their capital costs in their supplement. Over the last 7 quarters, they have ranged from 5.3% to 15.2% of gross rent. Over the long term, BDN is seeking to keep their capital costs in the 10-15% range.

There will be significant variance in this number as some leases will require significantly more than others. For example, a lease being renewed by the same tenant for the very first time will likely require few upgrades, while a new tenant moving into an office that was last renovated over a decade ago will likely want significant renovations.

LC and TI costs are simply the reality of business when leasing office space. For a REIT they usually are not a big deal. By definition, these costs do not exist until a new lease is signed which is a good thing. Wall Street can be a bit skittish when there are significant vacancies coming up, especially if the buildings are older and are likely to require significant renovation.

Not only does the REIT experience the up-front expense, but they also experience downtime for the property for the time it takes for construction. Large vacancies can disrupt cash flow. This is why you will often hear analysts asking about specific vacancies for office REITs more frequently than you will during conference calls with other REITs. For example, in the recent call,

Craig Mailman

It’s helpful and then, just curious, you have Comcast with the potential exit you talked about KPMG potentially – showing the early termination rate. Just as we kind of look at the same-store guidance that you guys gave at the Analyst Day last year, the 2% to 5%.

You guys are coming at the low end of it this year and you may have some potential drag. I am just curious as you guys kind of look out the – how you guys are feeling about maybe getting into the mid or high-end of that range in 2019 or 2020, kind of what has to fall in your favor for that to happen?

Jerry Sweeney

Yes, kind of couple things and we will tag team discuss. We are going to start realizing the benefit of a number of properties where we’ve created a lot of value and NOI growth coming into our same-store later this year.

As George touched on, we are right now in the process of really spending a lot of time with our – not only to start 2019 but also our 2020 rollovers Craig to try and figure out where they are – what they are lined up doing. Certainly, as George touched on a big sense that we have in our numbers for 2019 will be at KPMG; will they stay, will they go, we don’t know.

We have a great relationship with them. We have a excellent proposal in front of them. We have a wonderful team that in our DC operation works with them. But we’ve also started the process of what could be a very exciting kind of redevelopment or repositioning of that property and getting back a large block of set of space that we think has a significant positive mark-to-market.

If that eventuality comes into play, that would have a depressing effect on our 2019 same-store, because it also create much more accelerated growth in 2020 and beyond. So, we really identified all of our kind of 2019 target of renewals. Discussions are underway with all of those tenants at this point and our hope would be, as we always do our third quarter call, we’ll announce our 2019 guidance once we have more clarity.

On the positive side, Office REITs are usually aware of move-outs long before they actually occur. Moving or closing an office is usually a big deal for the tenants and is not a decision that is made hastily. The actual process of moving tends to take quite a bit of time as well. More often than not, office REITs will have a year or more notice and early terminations usually come with large fees that help offset the capital expense of putting in a new tenant.

While office REITs might have higher cap-ex when spaces become vacant, they carry an advantage of greater visibility, leases that discourage early terminations and longer average leases than most REITs.

More specifically to BDN, their capital costs can be expected to continue to be in the 10-15% range.

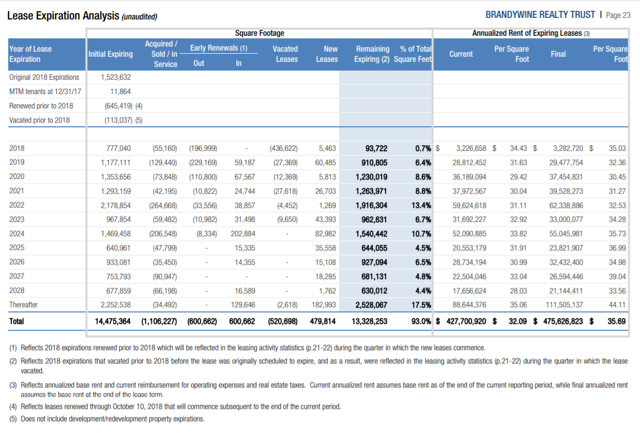

BDN has a healthy rollover schedule with most years having under 10% of their square footage up for renewal. With plenty of liquidity and a very focused geographical presence, I do not anticipate tenant rollover to be a significant risk for BDN.

Geographical Focus

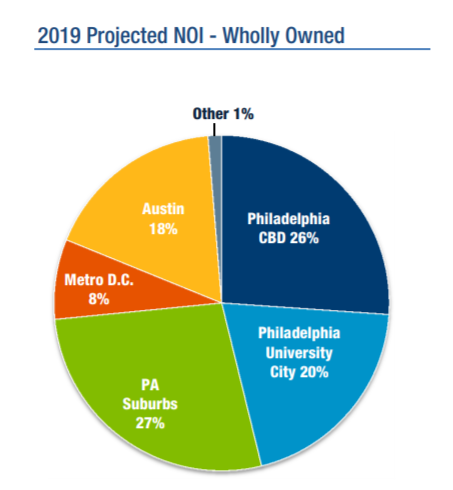

BDN engaged in two significant transactions in Q2. They entered into a JV, selling 85% interest in 1.3 million SF of office space in northern Virginia. BDN will retain 15% ownership as well as collect management fees. In exchange for contributing the properties to the JV, BDN will receive $292 million.

The proceeds from that sale are being used to partially fund buying out a different JV partner so that they will become the sole owner of approximately 1.57 million SF of space in Austin.

As a result of these two transactions, BDN will significantly increase their direct exposure to Austin. 99% of their NOI will come from their three core areas, Philadelphia, Metro DC and Austin.

Geographical concentration always carries a risk. If the Philadelphia office market experiences localized problems, it will have a significant impact on BDN.

Source: Cushman Wakefield Suburban Philadelphia

Fundamental indicators remain strong for Philadelphia, especially in the suburban areas where rent has continued to increase consistently. Downtown has been flat over the past year.

Source: Cushman Wakefield Downtown Philadelphia

Projections for the next 12 months remain positive, and BDN hopes that the Schuylkill Yards project will draw more economic activity into the city. Not only does the project itself have the potential to make significant money for BDN, but it should also help increase demand for their currently existing properties as well.

Being geographically focused is a risk if the area goes into a local recession, it can be a big benefit if an area outperforms. Additionally, it is much easier for leasing teams to fill space when they are focused on a single market. They are constantly in contact with tenants that want space specifically in their market and they have a selection of inventory readily available to suit the tenants’ needs or preferences.

Growth

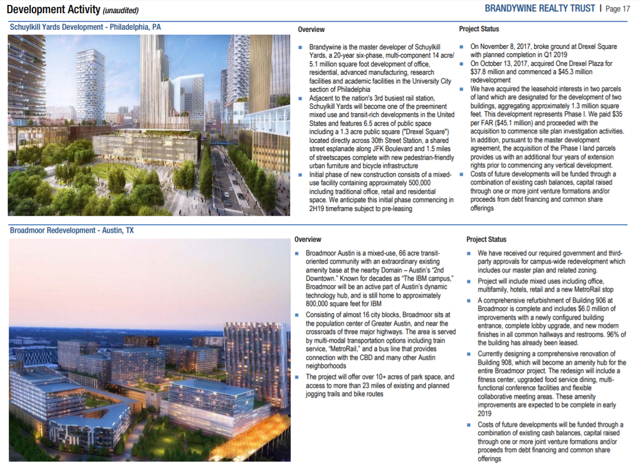

The big payoff for investors in BDN will be the success of Schuylkill Yards in Philadelphia and the Broadmoor Redevelopment in Austin.

These two projects are ambitious in scale. BDN is not just building a few office buildings, they are redeveloping entire portions of these cities. If successful, these will become the “go to” destinations in two of America’s fastest growing cities.

Construction has already started on both projects and the regulatory hurdles have already been cleared. Initially, the projects will require significant investment in infrastructure which does not result in immediate cash flow. As time goes on, both projects will start providing significant rent and the investment requirements to gain additional rent will diminish.

By the early 2020s, both of these projects could become cash-cows that will provide BDN with a straight-forward path to additional growth. Clearly, the biggest risk to BDN is that one or both of these projects fails to garner interest and they fail to obtain leases to build the envisioned space.

Conclusion

Mr. Market has not been a fan of BDN. Nor has he been a fan of office REITs. In my opinion, the concerns of office REITs is overplayed. Office space is changing, but it is not disappearing. Even tech companies like Amazon (AMZN) see a need of large office spaces.

BDN, in particular, has chosen to focus on strong markets and has become a dominant player in their markets. BDN is not only building office space, they are redeveloping entire blocks to modernize their core markets. This strategy has the potential to be extremely profitable, it also has the potential to lift the buildings they already own as success attracts more success.

The big risk for BDN is that the projects fail and become another idea that is never actually built. Investors looking into BDN today should focus their due diligence on assessing the risks of these projects, especially Schuylkill Yards, as BDN’s fortunes are likely to mirror the project.

At $14, BDN is trading at only 10x annualized FFO. BDN has manageable turnover, a very healthy balance sheet, plenty of liquidity and two projects which should produce steady growth for decades.

The big question is when will Mr. Market believe that BDN has the ability to realize that growth? I am a believer, and at these prices, I am happy to increase my bet.

Disclosure: I am/we are long BDN, AMZN.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.