Longtime MannKind (MNKD) investors are looking for silver linings while MannKind traders are taking dollars to the bank. This has been the MannKind story for years now, and that story continues despite some modest progress on Afrezza sales, a deal inked for inhaled treprostinil, and another quarter of living the corporate version of paycheck-to-paycheck in the books.

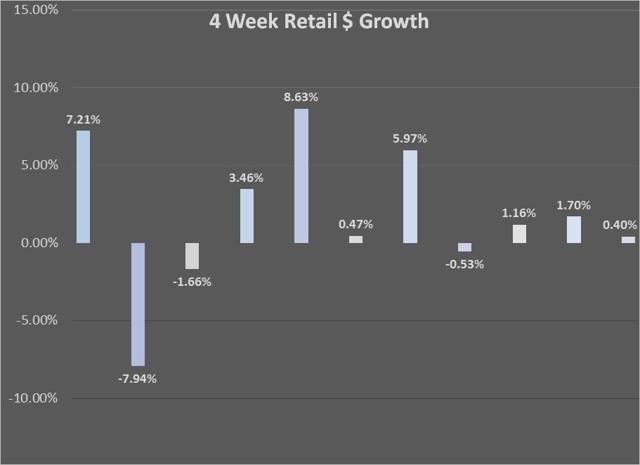

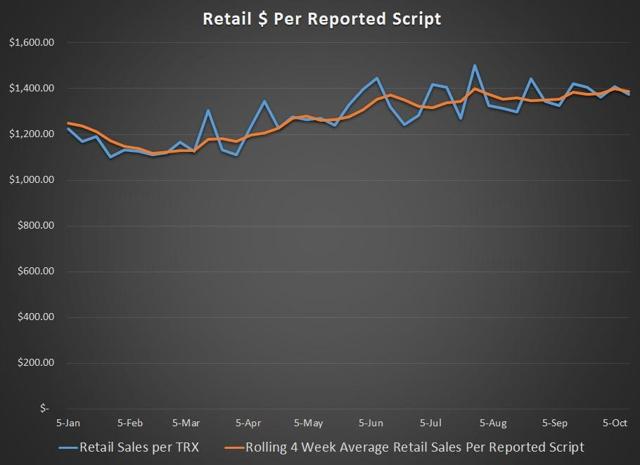

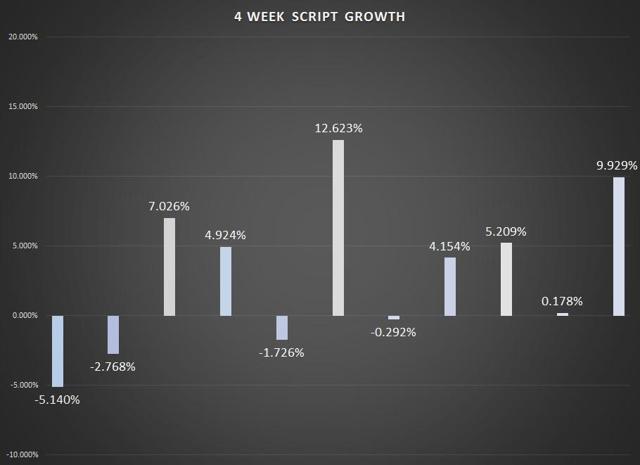

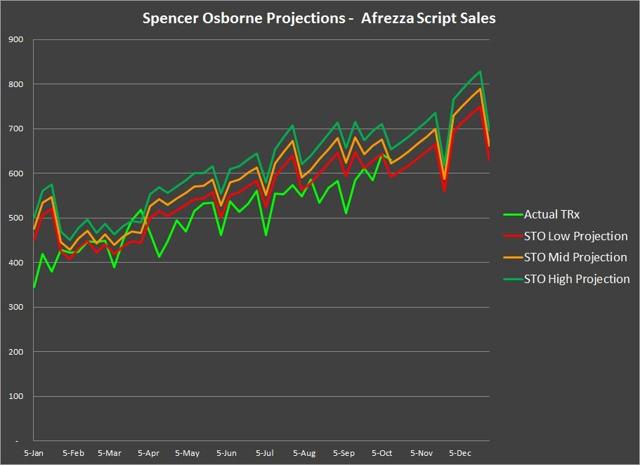

With another four-week period in the books, we can look at some of the trends in Afrezza sales. In terms of retail sales, the most recent 4-week total was just 0.40% better than the previous period, while script growth was at 9.29%. As I had discussed several times this year, the growth in retail per script will flatten out and come more in line with what we see in script growth.

Chart Source – Spencer Osborne (based in part on Symphony data)

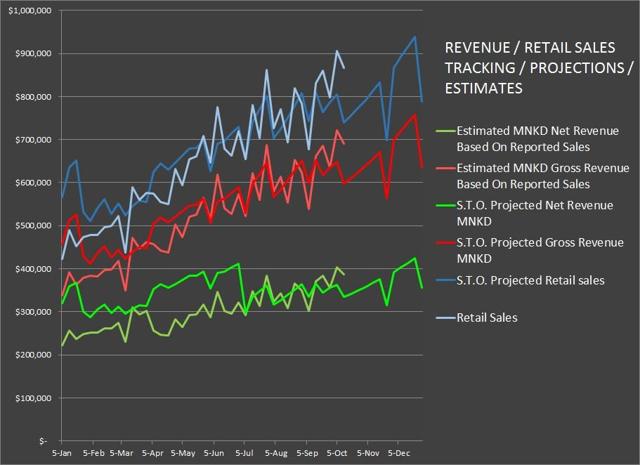

Chart Source – Spencer Osborne (based in part on Symphony data)

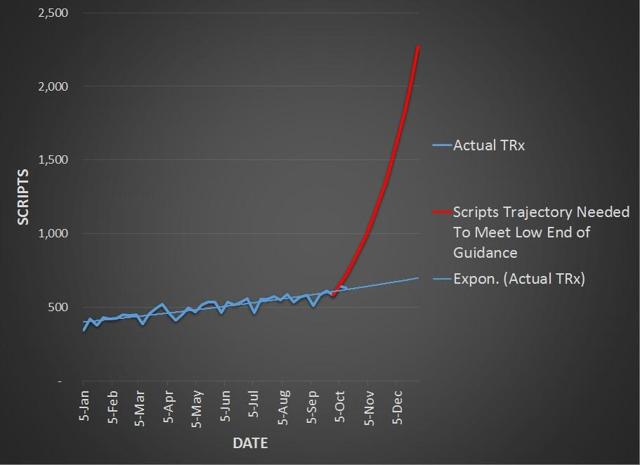

Chart Source – Spencer Osborne (based in part on Symphony data)

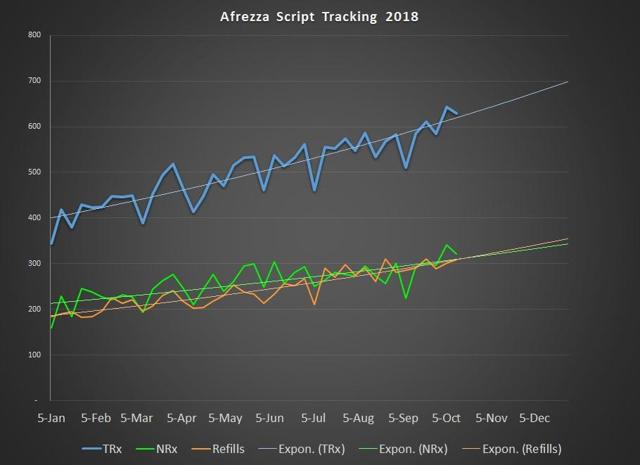

For the week ending October 12th, Afrezza scripts dipped to 630, but as you can see remained above the 600 mark. The concern that is most apparent is that sales growth is much slower than what is needed to drive the stock price or stem the cash burn. A less obvious concern with the 2018 numbers is that the trend line on refills is higher than the trend line on new scripts. The reason that this is a concern is that such dynamics typically happen when a drug is more mature and the reach of the drug has begun to be exhausted. This will be a dynamic that will only change if MannKind can shift its marketing strategy to something more robust.

Chart source – Spencer Osborne (based in part on Symphony data)

Projections

As regular readers know, I adjusted my projections downward at the beginning of the month. The good news is that sales are now pacing within my projections. The bad news is that my projections have MannKind missing its guided numbers by a wide margin.

Chart Source – Spencer Osborne

My projections on retail sales, gross revenue, and net revenue are now falling into line, but the good news/bad news dynamic remains the same. I am eager to see the numbers for Q3 on rebate activity and sales and marketing costs. A big question that savvy investors will have is whether the cost of growing scripts is productive or not. A good situation is when the costs to grow are showing enough progress to justify the expense. With MannKind being in somewhat of a survival mode, the company may not be able to do all of the things it would like to in terms of creating cost effective marketing.

Chart source – Spencer Osborne (based in part on Symphony data)

Guidance

MannKind guidance has been atrocious. Last year, the company fumbled badly on guidance and they followed that up with some serious errors this year. It was less than 8 months ago that the company outlined Afrezza net sales of between $25 million and $30 million. Just weeks later, management seemed to be cautioning to the lower end of guidance, but just 5 months ago the company reaffirmed its guidance stating, “We reaffirm our net revenue guidance as our revenue model continues to put us in the lower end of the $25 million to $30 million range for 2018.”

Two months ago the company lowered its guidance, but stated in the call that we should be confident that they will hit the lowered guidance. Here in mid-October, it seems widely apparent that the company is not going to hit the numbers, and in fact will likely miss by a wide margin. While some passionate MannKind fans may not want to hear it, the company is not doing what it indicated it would do, and that matters to the street.

As of October 12th, I estimate that MannKind has just $12.4 million in net Afrezza revenue. In order to hit the low end of guidance, the company must obtain $9.6 million in net revenue in the remaining 11 weeks of the year. Considering the slow rate of growth, it is widely apparent that a miss is in the cards, and that the company will have to discuss this matter in the Q3 call.

Chart Source – Spencer Osborne (based in part on Symphony data)

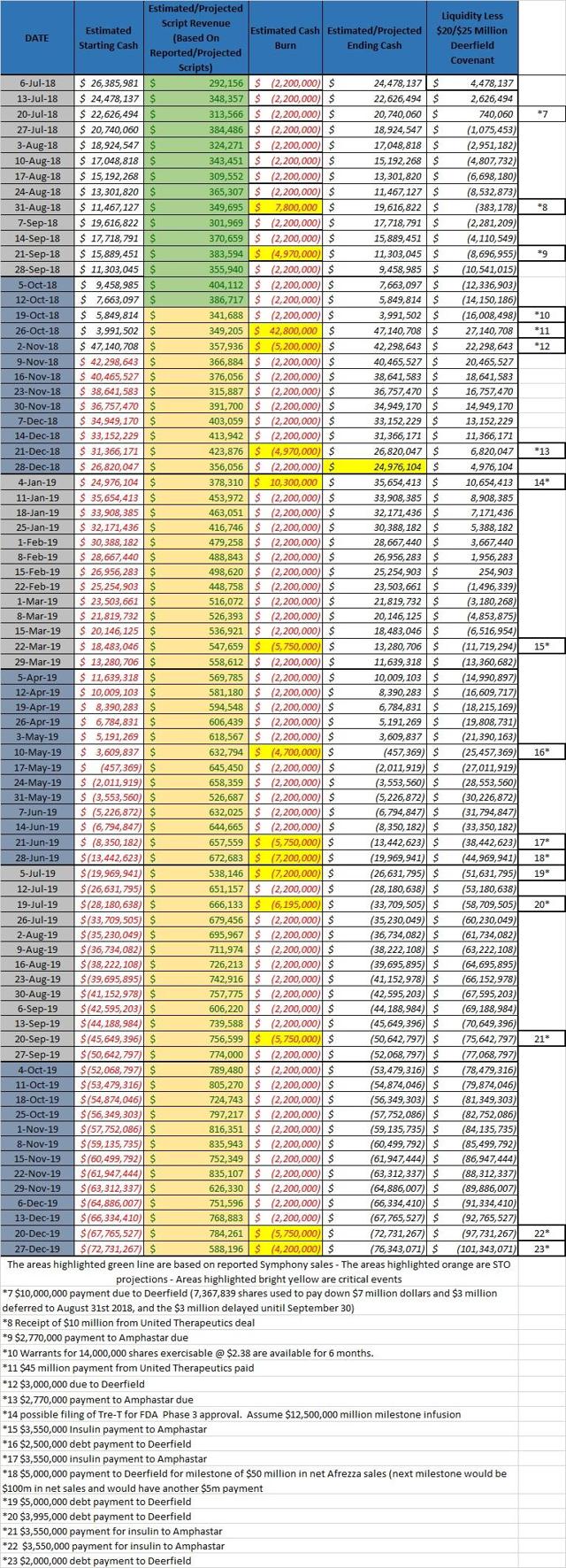

Cash

With the passage of the HSR waiting period on the MannKind deal with United Therapeutics (NASDAQ:UTHR), the company will get a much needed infusion of $45 million this week. $3 million of that will go right out the door with a cash payment to Deerfield. While that cash is much needed, it does not mean by any stretch that this company is fully funded. In fact, the cash chart below outlines things through the end of 2019. It assumes that MannKind will receive a $12.5 million milestone in January out of an anticipated $25 million in milestones that year. If we were to add another $12.5 million in milestones, and $30 million in warrants being exercised, the company will really only get to mid-summer of 2019. That is just 9 months away.

When one considers that MannKind needs to shift how Afrezza is marketed, spend money on pipeline development, and simply cannot allow cash to get that low, something needs to happen. Some investors feel that the Brazil deal will bring meaningful income. It will not. It does assist in using up the vast insulin supply MannKind is contracted to buy. The company needs another deal. United has already put $10 million toward another compound, but these things take time. Is another deal possible? Yes. That being said, the likelihood of more shares being used is very real. The problem with that is that MannKind is running out of share runway as well.

The facts are very simple. MannKind is not fully funded and investors need to be aware of that. This is a dynamic that plays into the hands of active traders that love the volatility of the MannKind stock price.

Chart Source – Spencer Osborne (based in part on Symphony data)

Warrants

The warrants seem to be a hot topic these days. There are 14 million warrant shares out there with an exercise price of $2.38 per share. These warrants are active between mid-October and mid-April. If they get exercised, the company’s coffers will have an additional $30 million. Some investors seem to think that the warrants automatically exercise if the stock price hits $2.38. This is not the case. The fact of the matter is that there are many possible ways that warrants can be played. In most cases, they are not very friendly to existing shareholders. The $30 million that these warrants would bring is badly needed, but the dilution of 14 million shares is the downside to the warrants. MannKind is almost approaching 160 million shares outstanding, which is substantially higher than the 95 million outstanding just after the reverse split.

I think most longer term investors would like to see the warrants taken out in one fell swoop and get the pain over with. In contrast, active traders want to see these warrants in play for the entire 6-month window as that creates the most volatility. The MannKind story has improved from 3 months ago, but the company still has some hurdles to address. There are possible positive press releases relating to a possible approval in Brazil, and possible filings for approval in Canada and/or Mexico. The company will put a positive spin on the Q3 call, which could build a bit of excitement. The negative press will be the slower than needed Afrezza sales leading to a likely guidance miss, and the company getting a bit hand tied on marketing after receiving a warning from the FDA, and the nuts and bolts of the Q3 call, which will be increased spending relating to Afrezza and lower than desired gross to net adjustments.

MannKind remains an equity that gives advantage to active traders in the near to mid term. Lofty price targets that some want to see can only happen when the company gets more improvement on its balance sheet and demonstrates that it can execute its sales plan with Afrezza. This company needs to have a 1-year cash cushion, but is not having much success getting its hands on that kind of money. Stay Tuned!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.